30-second summary:

- Board members, C-level, and Director+ level executives from retail and ecommerce, technology, media and publishing, and other businesses participated in our ClickZ and Search Engine Watch: Benchmark survey 2020

- 29.3% marketing leaders thought their current marketing technology stack is average in terms of achieving their marketing goals

- 46.3% said their marketing budgets are staying the same, while 28.4% said their marketing budgets are increasing

- Marketing leaders are planning to increase their marketing technology spends

- The top six technology marketers want to evaluate and invest in were – Search and social advertising, ecommerce marketing tools, experience building and management

- Lots more to discover in a quick snapshot

We picked the brains of Director+ level executives to bring you juicy data insights on martech spending budgets, the technology they are keen on buying with a further detailed drill-down of each segment. More observations from the industry’s biggest acquisitions in the first quarter.

ClickZ and Search Engine Watch: Benchmark survey 2020

We recently started tracking six core marketing trends to understand what’s brewing in the marketing technology industry and what exactly are marketing leaders thinking.

Board members, C-level execs, and Director+ level participants from professional services, retail and ecommerce, technology, media and publishing, and education businesses across UK, USA, and India participated in our benchmark survey.

Here are results of the ClickZ and Search Engine Watch: Benchmark survey 2020.

Some key takeaways:

- 46.3% respondents are keeping the same marketing budget

- Majority are looking to invest in search and social advertising technology

- 29.3% marketers thought their current marketing technology stack is average in terms of achieving their marketing goals

Marketers are more focused on maintaining their marketing budgets

- 46.3% said their marketing budgets are staying the same

- 28.4% said their marketing budgets are increasing

- 25.3 said their marketing budgets are decreasing

32% are increasing their spend on marketing technology

45.2% said they are sticking with their current spends on marketing technology, while 32.9% are increasing their marketing technology spends. There was also a smaller segment of 21.9% said they plan on decreasing their marketing technology budget.

How much marketing budget have marketers dedicated to marketing technology?

40% of the marketing budget is dedicated to marketing technology.

What technology are marketers keen on evaluating or purchasing right now?

Content and experience, data, advertising and promotion stood out as the most looked at technology investments.

The next segment gives you a detailed view of these specific technologies.

Top 6 technology marketers want to evaluate or purchase

Our Benchmark survey 2020 further drilled down specifics of technology types marketers are interested in evaluating or purchasing across niches of advertising, sales, management, and more.

Advertising and Promotion

Search and social advertising, mobile marketing, and display and programmatic advertising are the top three in this segment.

Commerce and Sales

Technology related to ecommerce marketing, affiliate marketing, and sales automation stood out as the most sorted after sub-sections that marketers would put their money on.

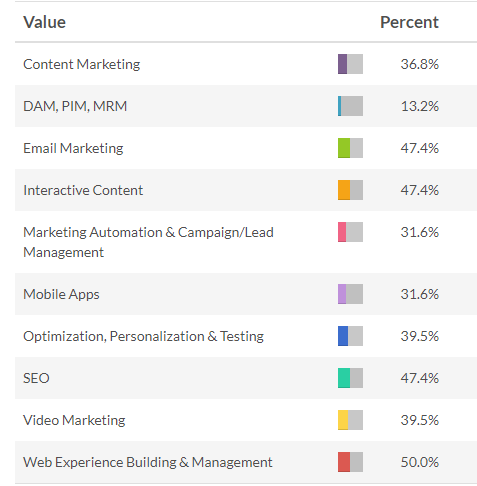

Content and Experience

Web experience building and management clocks in at numero uno with 50% marketers favouring it for an investment. The other hot favourites were – email marketing, interactive content, and SEO that tie-up at 47.4% each.

Data

Since data serves more like the all-knowing-eye of a business, the quality and technology serve as the make or break factors. Marketers’ most preferred technology investments were:

- Mobile and web analytics

- Marketing analytics, performance, and attribution

- Audience/Marketing data and data enhancement

The least interesting technology platforms were CDP, DMP, iPaas, cloud/data integration and tag management falling in a range of 13% to 15%.

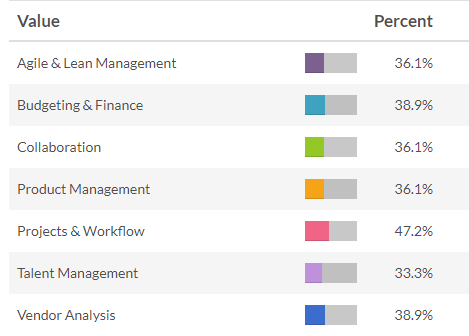

Management

Project and workflow management software got the lion’s share of the lot with 47.2%, the current work from home/remote work situation due to the COVID-19 lockdown could’ve been one.

Coming in second were budgeting and finance, and vector analysis with 38.9%. Collaboration, product management, and talent management software fall in the lowest slab of 33% to 36%.

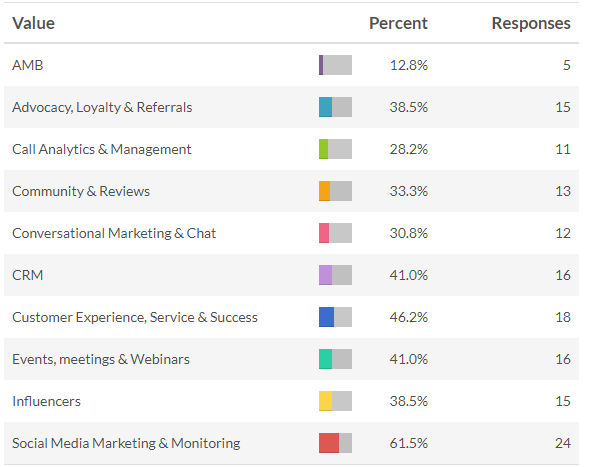

Social and Relationships

The pandemic has further proven that brand relations and sentiment matter. Which is why 61.5% marketers flocked towards wanting to invest in social media marketing and monitoring tools. Next in line were:

- Customer experience (46.2%)

- CRM (41%)

- Events, meetings and webinars (41%)

- Advocacy, loyalty, and referrals (38.5%)

- Influencers (38.5%)

Martech M&A deals dropped by less than 60%

Luma’s Q1 2020 Market Report showed that martech which was a hot market for M&As drastically dropped by ~60% both quarter-over-quarter and year-over-year.

Noteworthy martech M&A deal segments from Q1 2020

Despite the global economy slowdown, these were some marketing technology industry segments that saw acquisition deals complete.

- Personalization and CDP: Salesforce’s acquisition of personalization and CDP company

- CRM: Evergage and CRM tool developer Vlocity for $1.3 billion

- Customer acquisition platform: Platinum Equity acquired customer acquisition platform Centerfield

- Identity management: Zelnik Media Capital acquired identity-access management vendor Simeio.

- Email fraud prevention software: Risk Solutions group, LexisNexis acquired Emailage for $480MM

Other key takeaways

M&A deal counts fell in Q1 2020 which was lower than the expected when compared to Q1 2019:

- Adtech M&As: Dropped from 13 to 7 transactions

- Martech M&As: Dropped from 38 to 15

- Digital content M&As: Dropped from 23 to 18

However, M&As in the D2C sector rose from two to six transactions in Q1 2020. This is a positive indicator that the D2C sector would be better placed as consumers will be more comfortable to make the shift from brick-and-mortar retailers to online purchasing post the pandemic.

Top picks of topics our readers loved this week / Top picks for this week / Readers’ choice for this week

Steps to prepare for the business world past COVID-19. The weekly key insights articles continued to pique marketers’ interest.

A breath of fresh air was that our readers were also keen on non-COVID content which dealt with mastering competitor analysis for digital marketing success.

The post Key insights: ClickZ benchmark survey, state of industry M&As, and more appeared first on ClickZ.